MMM quantifies how various marketing activities contribute to a company’s KPIs – such as sales – the model’s accuracy hinges on the quality and comprehensiveness of the data fed into it. Typically, a dataset spanning at least 2* years is recommended to capture the cyclic nature of business and consumer patterns. This means you should have 2 years of data (time series) on:

In general, you should attempt to capture all major demand drivers in your model – if something is missing, there is a risk that the model predictions will be wrong. An example of a demand driver “map” for a retailer might be this:

There are exceptions to this and 2 years is not a “hard” limit – but you should take it as a general guideline and recommendation. Shorter data range may have negative consequences on the model quality in many cases.

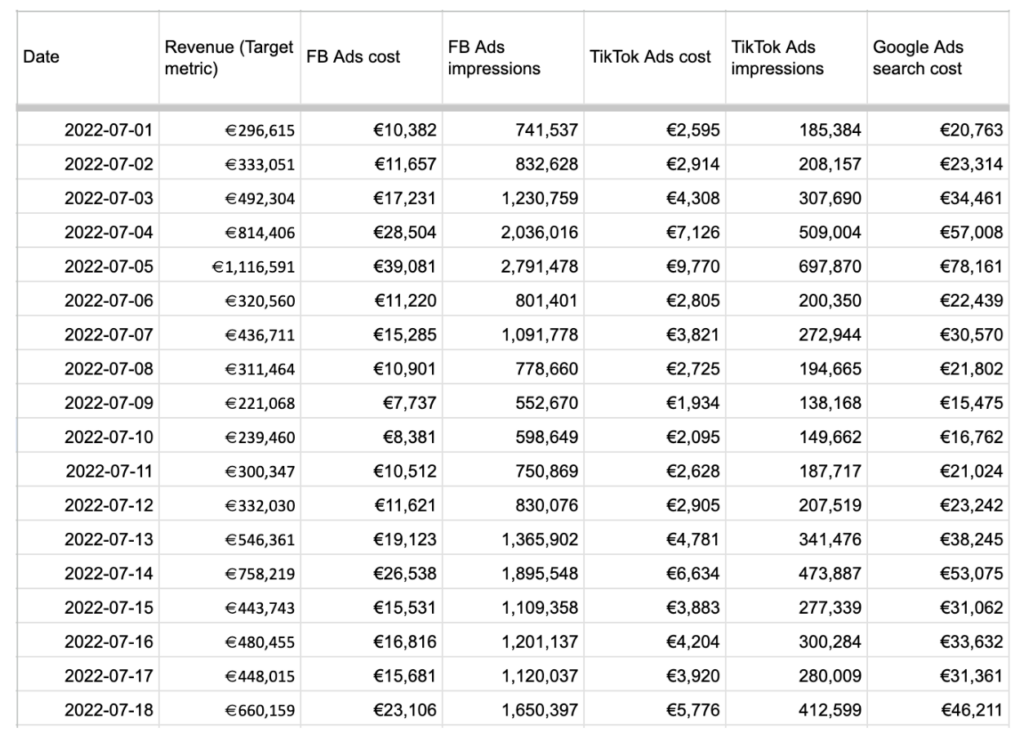

For a one-off analysis the format can be a simple Excel, CSV or Google Sheet looking like this:

…or for online platforms it is usually faster and easier to use connectors in your MMM solution. For always-on MMM solutions, there is always some form of data processing pipeline that ingests new data automatically and feeds them into the model.

For media the main question is how to structure the media channels into a so called channel grouping – e.g. should we treat Google Ads as 1 channel or should it be split into several by campaign type or objective or bidding strategy? This is something where your MMM partner should help you with guidance

All in all – designing a good channel grouping is quite important for MMM success and it is one of the areas where your MMM partner should help you as there are unavoidable trade-offs and navigating this requires experience with modelling and expert judgement.

In practice media channels are most often broken down into 10-20 channels in total and large platforms and mediatypes like Google, Facebook or TV usually into 2-5 “sub-channels”.

Daily data allow for a more granular channel grouping (more channels measured) but they may be too “noisy” in some cases which can make the modelling process much more difficult. This is something that needs to be decided case by case by the modeller.

No, but even for the first versions of the model, you should include all factors that probably impact your sales in a major way – main media channels, often pricing/discounting and major promotions.

Seasonality (yearly and weekly) is typically detected by the modelling process and you do not need to input it.

No, it is perfectly ok if you ran some channels only occasionally or only for some period of time.

For MMM to work, there needs to be some variance in the costs of a given channel (in some days/weeks you spend more than in others) – this is typically not a problem. But for example if you have a multi-year sponsorship of a sports club (and its start or end does not fall into the modelling period), it may be difficult or impossible to quantify its effect.